Not known Details About Quick Payday Loan

What Does Quick Payday Loans Of 2022 Do?

Table of ContentsThe Ultimate Guide To LoansExcitement About Payday LoanUnknown Facts About Quick Payday LoanQuick Payday Loan Things To Know Before You Get ThisThe Quick Payday Loan Ideas

You can inspect your rights when you make use of a credit rating broker. Make sure you go shopping around for the finest bargain. On the internet payday lending institutions have to release their deals on a minimum of 1 cost contrast web site so you can compare their take care of others. The price contrast site must be controlled by the Financial Conduct Authority.

Make certain you utilize the company's name instead of the web site name when examining - it'll generally get on their homepage. When you get a car loan, before providing you any cash, a loan provider must check whether you'll be able to pay it back. This indicates that, for instance, the lender should check you have actually obtained enough cash can be found in every month to be able to pay the loan back.

What Does Loans Mean?

If there isn't sufficient cash in your account to repay the financing on the agreed day, the lender might keep asking your bank for all or component of the cash. Costs will be included for late settlement. However, your loan provider should not use the certified public accountant greater than two times if they've not been able to get the cash from your account, and also they shouldn't attempt to take a part payment.

The lending institution may do this by providing you more time to pay the finance or by rolling the loan over. A rollover functions by making a new agreement for the repayment of the original financing. Be cautious of prolonging your financing or accepting it being rolled over because you will certainly need to pay off even more money to the loan provider as you will be charged additional passion, added fees or various other added charges.

Everything about Payday Loans

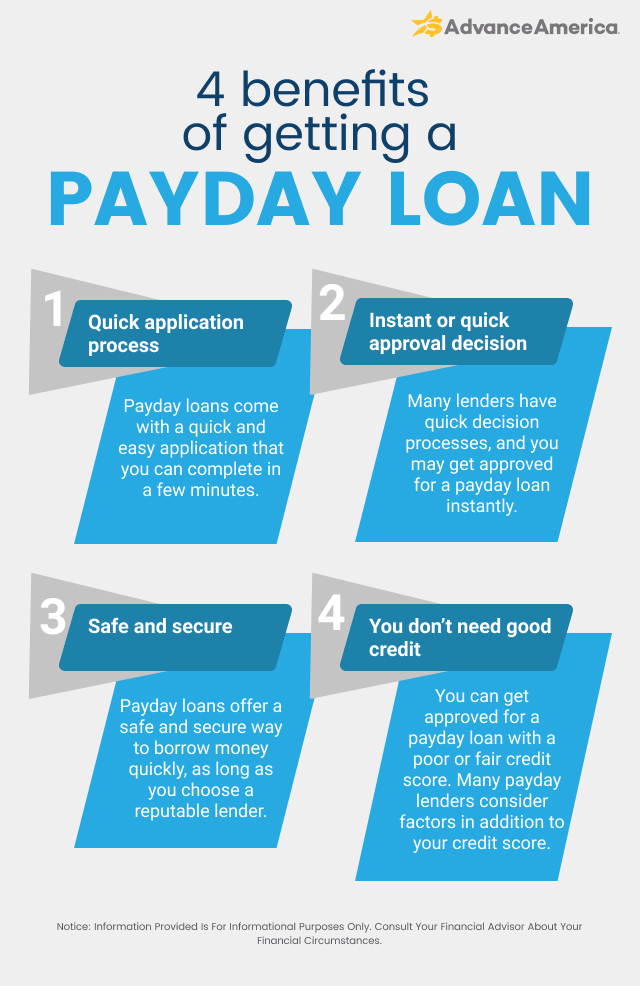

, particularly when you can pay back the car loan as arranged. Below are some benefits of getting a cash advance financing with poor credit history to cover expenses: Cash advance lendings usually come with a simple application procedure that debtors can complete online.

When you request a payday advance, you may get an immediate or quick choice from the lender. If approved, the lending institution may give you the funds as soon as the exact same day you use or within 24-hour. You do not require good credit rating to look for a cash advance.

This indicates individuals can still obtain approved also if they have poor credit. Little payday advance loan online, also with negative credit history, are a wind to request. Here's what you'll Quick Payday Loans of 2022 need to do if you would certainly such as to take one out. Before you start the application procedure, ensure you have the complying with info on hand: Legitimate Social Protection number Legitimate and energetic e-mail address Energetic bank account Income source (such as a paystub) Most likely to the application and also total these actions to get a cash advance with bad credit scores: Share your individual contact details.

Unknown Facts About Payday Loan

Typically speaking, the longer you've had your charge account open and also in excellent standing, the higher your score will certainly be. Payday Loans. If you can, attempt to maintain your old accounts open, also if you wish to prevent using them or have a no balance. The amount of financial obligation you have actually split by the amount of credit rating offered to you is called your credit report usage ratio.

Upon authorization, you'll give the lender your title in exchange for a lump amount of money, based on the value of your vehicle. You'll be able to drive your car as you repay your lending.

You can take out cash whenever you would certainly such as up to a set credit rating restriction, and you'll only pay passion on the quantity you borrow. Lines of credit history should be on your radar if you 'd such as an adaptable finance.

The Of Quick Payday Loans Of 2022

A payday advance loan is a type of short-term loaning where a loan provider will expand high-interest credit rating based on your income. Its principal is typically a section of your following paycheck. Payday advance bill high rates of interest for temporary immediate credit rating. They are additionally called cash loan finances or inspect breakthrough finances.

, making them a type of unprotected personal car loan., as they have very high passion, don't think about a consumer's capability to pay back, as well as have actually concealed arrangements that bill consumers included charges.

If you're taking into consideration a payday advance, after that you might want to look initially at safer personal financing options. Cash advance suppliers will typically require you to reveal proof of your incomeusually your pay stubs from your company. They will certainly then lend you a part of the cash that you will certainly be paid.